For those (like me) concerned about how

much health spending continues to increase after Obamacare, today’s second report

of fourth quarter Gross Domestic Product shows concern is still warranted.

Because of revisions to the advance estimate, health spending accounted for a

greater share of GDP than we had thought.

Overall, real GPD increased 1.8 percent on

the quarter, while health services spending increased 5.6 percent, and

contributed 36 percent of real GDP growth. Growth in health services spending

was much higher than growth in non-health services spending (0.3 percent) and

non-health personal consumption expenditures (2.4 percent). However, the implied

annualized change in the health services price index increased by just 1.6

percent, lower than the price increase of 2.4 percent for non-health services,

2.0 percent for non-health PCE, and 2.1 percent for non-health GDP.

(See Table I below the fold.)

Longer term, growth in health services

spending is also high, having grown 4.8 percent since 2015 Q4, versus 1.5 percent

for non-health services, 2.6 percent for non-health PCE, and 1.5 percent for

non-health GDP (Table II). Implied inflation for health services was in line

with GDP.

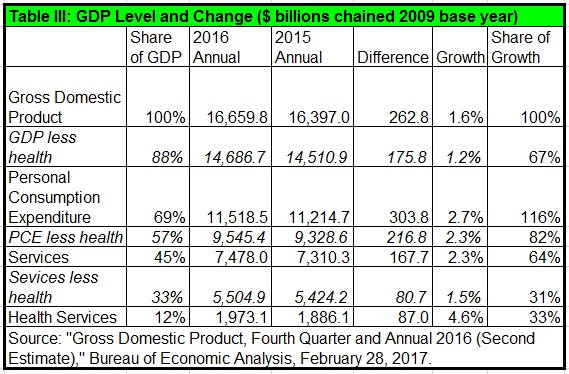

However, the full-year GDP for 2016 also

shows disproportionately high growth in health spending, which rose 4.6 percent

versus just 1.5 percent for non-health services spending, 2.3 percent for

non-health personal consumption expenditures, and 1.2 percent for non-health

GDP (Table III).

Technical note: Until the July

29, 2016 entry on the GDP release, I discussed nominal GDP growth. As of August

26, 2016, these updates discuss real GDP growth, in line with the way most

media cover GDP. However, as of the October 28, 2016 entry, I add a column that

estimates changes in the price indices, calculated from the news release.

When I discuss health services in these

quarterly GDP releases, I mean only health services. I do not include purchases

of medical equipment, or facilities construction.

While I include Medicare and

Medicaid, I do not include Veterans Health Administration or other government

benefits. So, these dollar figures undercount the amount of

our economy consumed by the government-health complex.

(See: Measuring the Economy: A

Primer on the GDP and the National Income and

Product Accounts, Bureau of

Economic Analysis, October 2014, pages 5-2 and 5-3; Micah B. Hartman, et

al., “A Reconciliation of Health Care Expenditures in the National Health

Expenditures Accounts and in Gross Domestic Product,” Research Spotlight, Survey

of Current Business, September 2010, pages 42-52.)

Professor Christopher Conover explains why

some scholars de-emphasize CPI and medical CPI as appropriate measures of

inflation for health care, preferring Personal Consumption Expenditures (PCE),

which I discuss here. The PCE price index is updated only quarterly, which is

why I interpolate from monthly GDP releases. However, health spending in PCE is

only services. Prices for goods, such as drugs and medical devices are not

considered here.

No comments:

Post a Comment